Carbon Tax

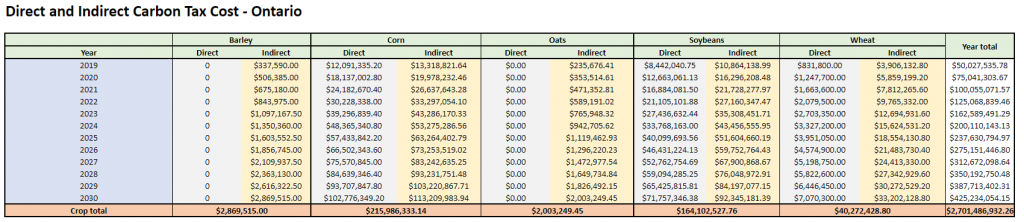

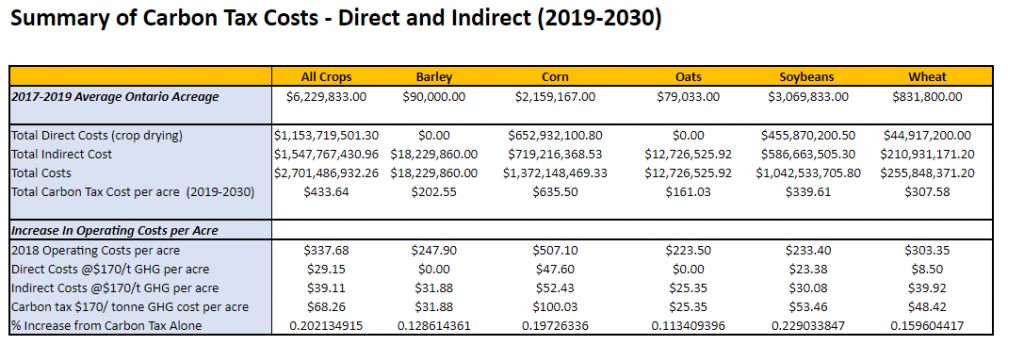

By 2030, it is estimated that up to $2.7 billion of carbon tax will be paid by Ontario grains and oilseed farmers. This tax collected cannot be passed along to customers as farmers are price takers and prices are established at the Chicago Board of Trade.

The concept of providing an incentive for change is only acting like a penalty for farmers who have no alternatives available to them. This is money that is coming right out of the farmers’ pocket.

This tax would have had the potential to be reinvested in lower-carbon agriculture practices that help grow the rural economy of Ontario. Providing this relief to grain farmers allows for more investment toward proven on-farm climate smart practices.

Support MP Ben Lobb’s Private Member’s Bill C-234: An Act to amend the Greenhouse Gas Pollution Pricing Act. Tell your local MP that you support Bill C-234 and they should too.

Former Grain Farmers of Ontario chair, Brendan Byrne, wrote an op-ed for the Hill Times highlighting the importance of Bill C-234 — an Act to amend the Greenhouse Gas Pollution Pricing Act, which seeks to give farmers a short-term break from Canada’s price on pollution for grain drying until the technological solutions we seek are found.